The Influence of Financial Behavioral Dimensions on Student Financial Management

Keywords:

Financial Attitude, Financial Experience, Financial Literacy, Financial Management Behavior, Materialistic LifestyleAbstract

This research aims to construct a structural model of financial management behavior of students at Lambung Mangkurat University, with a focus on the influence of financial attitudes (FA), financial experience (FE), financial literacy (FL), and materialism lifestyle (ML) on financial management behavior (FMB). To explore this phenomenon, the research used quantitative methods with Structural Equation Modeling-Partial Least Squares (SEM-PLS). The number of research respondents was 269 active students at Lambung Mangkurat University. The research results have crucial implications in improving attitudes, experiences and financial literacy, as well as controlling materialistic lifestyles among students. By improving these aspects, it is hoped that students will be able to better understand how to manage finances, make wise and responsible financial decisions.

Downloads

References

Aftab, R., Gul, S., Fernandes, L. P., & Thomas, A. (2023). The Role of Materialism in Life satisfaction : An empirical investigation of university students. 10(1993), 2503–2510.

Amagir, A., Groot, W., van den Brink, H. M., & Wilschut, A. (2020). Financial literacy of high school students in the Netherlands: knowledge, attitudes, self-efficacy, and behavior. International Review of Economics Education, 34(May), 100185. https://doi.org/10.1016/j.iree.2020.100185

Ameliawati, M., & Setiyani, R. (2018). The Influence of Financial Attitude, Financial Socialization, and Financial Experience to Financial Management Behavior with Financial Literacy as the Mediation Variable. KnE Social Sciences, 3(10), 811. https://doi.org/10.18502/kss.v3i10.3174

Anggraini, M., Ignatius, H., & Setyawan, R. (2021). Determinant Factors of Financial Management Behavior Among People in Jakarta During COVID-19 Pandemic. 570(Icebsh), 131–136.

Anggraini, N., Santoso, R. A., Handayani, A., & Rizqi, M. A. (2022). Financial Attitude, Financial Knowledge, and Income on Muhammadiyah University of Gresik’s Management Students’ Financial Behavior. Interdisciplinary Social Studies, 1(6), 757–765. https://doi.org/10.55324/iss.v1i6.150

Ansong, A., & Gyensare, M. A. (2012). Determinants of University Working-Students’ Financial Literacy at the University of Cape Coast, Ghana. International Journal of Business and Management, 7(9). https://doi.org/10.5539/ijbm.v7n9p126

Arianti, B. F. (2017). The influence of financial knowledge, control and income on individual financial behavior. European Research Studies Journal, 20(3), 635–648.

Arifin, A. Z., Anastasia, I., Siswanto, H. P., & Henny, . (2019). The Effects of Financial Attitude, Locus of Control, and Income on Financial Behavior. 59–66. https://doi.org/10.5220/0008488200590066

Arofah, A. A., Purwaningsih, Y., & Indriayu, M. (2018). Financial Literacy, Materialism and Financial Behavior. International Journal of Multicultural and Multireligious Understanding, 5(4), 370. https://doi.org/10.18415/ijmmu.v5i4.171

Atmadja, A. T., Adi, K., Saputra, K., Manurung, D. T. H., & Wulandari, R. (2021). Factors That Influence Financial Management : A Case Study in Indonesia. Journal of Asian Finance, Economics and Business, 8(6), 1203–1211. https://doi.org/10.13106/jafeb.2021.vol8.no6.1203

Awanis, S., Schlegelmilch, B. B., & Cui, C. C. (2017). Asia’s materialists: Reconciling collectivism and materialism. Journal of International Business Studies, 48(8), 964–991. https://doi.org/10.1057/s41267-017-0096-6

Aydin, A. E., & Akben Selcuk, E. (2019). An investigation of financial literacy, money ethics and time preferences among college students: A structural equation model. International Journal of Bank Marketing, 37(3), 880–900. https://doi.org/10.1108/IJBM-05-2018-0120

Bado, B., Hasan, M., Tahir, T., & Hasbiah, S. (2023). How do Financial Literacy, Financial Management Learning, Financial Attitudes and Financial Education in Families Affect Personal Financial Management in Generation Z? International Journal of Professional Business Review, 8(5), e02001. https://doi.org/10.26668/businessreview/2023.v8i5.2001

Baker, H. K., Kumar, S., Goyal, N., & Gaur, V. (2019). How financial literacy and demographic variables relate to behavioral biases. Managerial Finance, 45(1), 124–146. https://doi.org/10.1108/MF-01-2018-0003

Bamforth, J., Jebarajakirthy, C., Geursen, G., Bamforth, J., Jebarajakirthy, C., & Geursen, G. (2018). financial literacy Understanding undergraduates ’ money management behaviour : a study beyond financial literacy behaviour. https://doi.org/10.1108/IJBM-05-2017-0104

Bannier, C. E., & Schwarz, M. (2018). Gender- and education-related effects of financial literacy and confidence on financial wealth. Journal of Economic Psychology, 67, 66–86. https://doi.org/10.1016/j.joep.2018.05.005

Bapat, D. (2019). Exploring Antecedents to Financial Management Behavior for Young Adults. 30(1), 44–55.

Bapat, D. (2020). Antecedents to responsible financial management behavior among young adults: moderating role of financial risk tolerance. International Journal of Bank Marketing, 38(5), 1177–1194. https://doi.org/10.1108/IJBM-10-2019-0356

Clarence, J., & Pertiwi, D. (2023). Financial Management Behavior Among Students: the Influence of Digital Financial Literacy. International Journal of Financial and Investment Studies (IJFIS), 4(1), 9–16. https://doi.org/10.9744/ijfis.4.1.9-16

Coskun, A., & Dalziel, N. (2020). Research in Business & Social Science Mediation effect of financial attitude on financial knowledge and financial behavior : The case of university students. International Journal of Research In Business and Social Science, 9(2), 1–8.

Ćumurović, A., & Hyll, W. (2019). Financial Literacy and Self-Employment. Journal of Consumer Affairs, 53(2), 455–487. https://doi.org/10.1111/joca.12198

Digdowiseiso, K. (2023). The Influence of Financial Attitude, Financial Knowledge, And Locus Of Control On Financial Management Behavior In Employee Class S1 Students In Management Study Program Faculty of Economics And Business National University. Jurnal Ekonomi, 12(02), 2023. http://ejournal.seaninstitute.or.id/index.php/Ekonomi

Frijns, B., Gilbert, A., & Tourani-Rad, A. (2014). Learning by doing: The role of financial experience in financial literacy. Journal of Public Policy, 34(1), 123–154. https://doi.org/10.1017/S0143814X13000275

Gatersleben, B., Jackson, T., Meadows, J., Soto, E., & Yan, Y. L. (2018). Leisure, materialism, well-being and the environment. Revue Europeenne de Psychologie Appliquee, 68(3), 131–139. https://doi.org/10.1016/j.erap.2018.06.002

Górnik-Durose, M. E. (2020). Materialism and Well-Being Revisited: The Impact of Personality. Journal of Happiness Studies, 21(1), 305–326. https://doi.org/10.1007/s10902-019-00089-8

Goyal, K., & Kumar, S. (2021). Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies, 45(1), 80–105. https://doi.org/10.1111/ijcs.12605

Grohmann, A. (2018). Financial literacy and financial behavior: Evidence from the emerging Asian middle class. Pacific Basin Finance Journal, 48(January), 129–143. https://doi.org/10.1016/j.pacfin.2018.01.007

Hancock, A. M., Jorgensen, B. L., & Swanson, M. S. (2013). College Students and Credit Card Use: The Role of Parents, Work Experience, Financial Knowledge, and Credit Card Attitudes. Journal of Family and Economic Issues, 34(4), 369–381. https://doi.org/10.1007/s10834-012-9338-8

Hasibuan, B. K., Lubis, Y. M., & HR, W. A. (2018). Financial Literacy and Financial Behavior as a Measure of Financial Satisfaction. 46(Ebic 2017), 503–507. https://doi.org/10.2991/ebic-17.2018.79

Hussain, J., Salia, S., & Karim, A. (2018). Is knowledge that powerful? Financial literacy and access to finance: An analysis of enterprises in the UK. Journal of Small Business and Enterprise Development, 25(6), 985–1003. https://doi.org/10.1108/JSBED-01-2018-0021

Iramani, R., & Lutfi, L. (2021). An integrated model of financial well-being: The role of financial behavior. Accounting, 7(3), 691–700. https://doi.org/10.5267/j.ac.2020.12.007

Jorgensen, B. L., Rappleyea, D. L., Schweichler, J. T., Fang, X., & Moran, M. E. (2017). The Financial Behavior of Emerging Adults: A Family Financial Socialization Approach. Journal of Family and Economic Issues, 38(1), 57–69. https://doi.org/10.1007/s10834-015-9481-0

Joseph F. Hair, J., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). 148337744X-PLS-SEM.pdf.

Kisdayanti, L., & Pertiwi, T. K. (2021). Behavioral Financial Analysis in Internal Locus of Control Mediation on Private Employees Surabaya. IJEBD (International Journal of Entrepreneurship and Business Development), 4(4), 532–542. https://doi.org/10.29138/ijebd.v4i4.1470

Laga, A., Hizazi, A., & Yuliusman. (2023). The Effect of Financial Literacy, Financial Attitude, Locus of Control, and Lifestyle on Financial Management Behavior (Case Study on Undergraduate Accounting Study Program Students Faculty of Economics and Business Jambi University). Indonesian Journal of Economic & Management Sciences, 1(4), 459–480. https://doi.org/10.55927/ijems.v1i4.4977

Lim, W. M. (2015). Antecedents and consequences of e-shopping: An integrated model. In Internet Research (Vol. 25, Issue 2). https://doi.org/10.1108/IntR-11-2013-0247

Liu, L., & Zhang, H. (2021). Financial literacy, self-efficacy and risky credit behavior among college students: Evidence from online consumer credit. Journal of Behavioral and Experimental Finance, 32, 100569. https://doi.org/10.1016/j.jbef.2021.100569

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1–8. https://doi.org/10.1186/s41937-019-0027-5

Mashud, M., Mediaty, M., & Pontoh, G. T. (2021). The Effect of Financial Literature, Lifestyle and Income of Parents on Student Financial Management Behavior. Journal of International Conference Proceedings, 4(3), 256–264. https://doi.org/10.32535/jicp.v4i3.1315

Mohd Kamel, A., & Sahid, S. (2021). Financial literacy and financial behaviour of university students in Malaysia. Turkish Online Journal of Qualitative Inquiry (TOJQI), 12(9), 1208–1220.

Morgan, P., & Trinh, L. (2019). Determinants and Impacts of Financial Literacy in Cambodia and Viet Nam. Journal of Risk and Financial Management, 12(1), 19. https://doi.org/10.3390/jrfm12010019

Nano, D. (2015). The Interrelationship between Financial Attitude, Financial Behavior and Financial Knowledge. International Journal of Business & Technology, 4(1). https://doi.org/10.33107/ijbte.2015.4.1.09

Pamella, C. D., & Darmawan, A. (2022). The Effect of Financial Literacy , Financial Attitude , Locus of Control and Income on Financial Management Behavior on the Millennial Generation.

Pandelaere, M. (2016). Materialism and well-being: The role of consumption. Current Opinion in Psychology, 10, 33–38. https://doi.org/10.1016/j.copsyc.2015.10.027

Pham, T. H., Yap, K., & Dowling, N. A. (2012). The impact of financial management practices and financial attitudes on the relationship between materialism and compulsive buying. Journal of Economic Psychology, 33(3), 461–470. https://doi.org/10.1016/j.joep.2011.12.007

Potrich, A. C. G., Vieira, K. M., & Kirch, G. (2018). How well do women do when it comes to financial literacy? Proposition of an indicator and analysis of gender differences. Journal of Behavioral and Experimental Finance, 17, 28–41. https://doi.org/10.1016/j.jbef.2017.12.005

Purwidianti, W., Tubastuvi, N., Darmawan, A., & Rahmawati, I. Y. (2022). Does Financial Behavior Mediate The Relationship Between Financial Literacy and Financial Experience Towards Financial Performance of Small Businesses? Proceedings of the International Conference on Sustainable Innovation Track Accounting and Management Sciences (ICOSIAMS 2021), 201(Icosiams 2021), 235–241. https://doi.org/10.2991/aebmr.k.211225.033

Rai, K. (2017). Association of Financial Attitude , Financial Behaviour and Financial Knowledge Towards Financial Literacy : A Structural Equation Modeling Approach. 1–10. https://doi.org/10.1177/2319714519826651

Rai, K., Dua, S., & Yadav, M. (2019). Association of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modeling Approach. FIIB Business Review, 8(1), 51–60. https://doi.org/10.1177/2319714519826651

Romadhon, R., Abrar, R., Suwandari, L., Soedirman, U. J., & Romadhon, R. (2021). Matrealism Forms Consumer Compulsive Buying With Fashion Orientation As Mediation ( Survey On @ Appleblossom . Id Followers ). International Sustainable Competitiveness Advantage 2021 Matreal, 868–875.

Shah, A., & Patel, J. (2020). Impact Of Financial Behaviour And Financial Attitude On Level Of Financial Literacy Amongst Youth: An Sem Approach. Ilkogretim Online - Elementary Education Online, 19(4), 8024–8036. https://doi.org/10.17051/ilkonline.2020.04.765196

Sohn, S. H., Joo, S. H., Grable, J. E., Lee, S., & Kim, M. (2012a). Adolescents’ financial literacy: The role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth. Journal of Adolescence, 35(4), 969–980. https://doi.org/10.1016/j.adolescence.2012.02.002

Sohn, S. H., Joo, S. H., Grable, J. E., Lee, S., & Kim, M. (2012b). Adolescents’ financial literacy: The role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth. Journal of Adolescence, 35(4), 969–980. https://doi.org/10.1016/j.adolescence.2012.02.002

Stolper, O. A., & Walter, A. (2017). Financial literacy, financial advice, and financial behavior. Journal of Business Economics, 87(5), 581–643. https://doi.org/10.1007/s11573-017-0853-9

Strömbäck, C., Lind, T., Skagerlund, K., Västfjäll, D., & Tinghög, G. (2017). Does self-control predict financial behavior and financial well-being? Journal of Behavioral and Experimental Finance, 14, 30–38. https://doi.org/10.1016/j.jbef.2017.04.002

Swiecka, B., Yeşildağ, E., Özen, E., & Grima, S. (2020). Financial literacy: The case of Poland. Sustainability (Switzerland), 12(2), 1–17. https://doi.org/10.3390/su12020700

Tang, N., Baker, A., & Peter, P. C. (2015). Investigating the Disconnect between Financial Knowledge and Behavior: The Role of Parental Influence and Psychological Characteristics in Responsible Financial Behaviors among Young Adults. Journal of Consumer Affairs, 49(2), 376–406. https://doi.org/10.1111/joca.12069

Tanuwijaya, K., & Setyawan, I. R. (2021). Can financial literacy become an effective mediator for investment intention? Accounting, 7(7), 1591–1600. https://doi.org/10.5267/j.ac.2021.5.011

Thomas, B., & Subhashree, P. (2020). Factors that influence the financial literacy among engineering students. Procedia Computer Science, 172(2019), 480–487. https://doi.org/10.1016/j.procs.2020.05.161

Topa, G., Zappalà, S., Giorgi, G., & Europea, U. (2018). Financial Management Behavior Among Young Adults : The Role of Need for Cognitive Closure in a Three-Wave Moderated Mediation Model. 9(November), 1–10. https://doi.org/10.3389/fpsyg.2018.02419

Wang, K., Chen, Y., Liu, Y., & Tang, Y. (2023a). Board secretary’s financial experience, overconfidence, and SMEs’ financing preference: Evidence from China’s NEEQ market. Journal of Small Business Management, 61(4), 1378–1410. https://doi.org/10.1080/00472778.2020.1838177

Wang, K., Chen, Y., Liu, Y., & Tang, Y. (2023b). Board secretary’s financial experience, overconfidence, and SMEs’ financing preference: Evidence from China’s NEEQ market. Journal of Small Business Management, 61(4), 1378–1410. https://doi.org/10.1080/00472778.2020.1838177

Watson, D. C. (2019). Materialism: Temporal balance, mindfulness and savoring. Personality and Individual Differences, 146(March), 93–98. https://doi.org/10.1016/j.paid.2019.03.034

Welles, C. (2019). Economics and Business Reporting. The Columbia Knight-Bagehot Guide to Economics and Business Journalism, 2(2), XIII–XXIV. https://doi.org/10.7312/klug93224-003

Widyakto, A., Liyana, Z. W., & Rinawati, T. (2022). The influence of financial literacy, financial attitudes, and lifestyle on financial behavior. Diponegoro International Journal of Business, 5(1), 33–46. https://doi.org/10.14710/dijb.5.1.2022.33-46

Wijanarko, A. H., Sulastri, S., & ... (2022). The Factors that Influence Saving Behaviour of Student at State Polytechnic of Sriwijaya. … International Research and …, 20379–20388. https://www.bircu-journal.com/index.php/birci/article/view/6055

Ye, J., & Kulathunga, K. M. M. C. B. (2019). How does financial literacy promote sustainability in SMEs? A developing country perspective. Sustainability (Switzerland), 11(10), 1–21. https://doi.org/10.3390/su11102990

Yogasnumurti, R. R., Sadalia, I., & Irawati, N. (2021). The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students. Ebic 2019, 649–657. https://doi.org/10.5220/0009329206490657

Zahra, D. R., & Anoraga, P. (2021). The Influence of Lifestyle, Financial Literacy, and Social Demographics on Consumptive Behavior. Journal of Asian Finance, Economics and Business, 8(2), 1033–1041. https://doi.org/10.13106/jafeb.2021.vol8.no2.1033

Zulaihati, S., Susanti, S., & Widyastuti, U. (2020). Teachers’ financial literacy: Does it impact on financial behaviour? Management Science Letters, 10(3), 653–658. https://doi.org/10.5267/j.msl.2019.9.014

Downloads

Published

How to Cite

Issue

Section

License

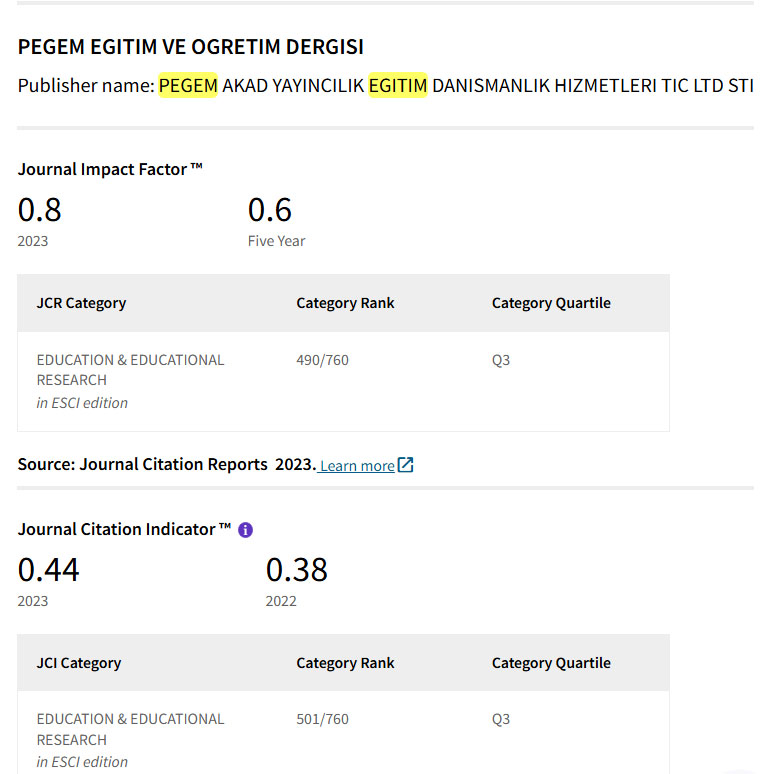

Copyright (c) 2024 Pegem Journal of Education and Instruction

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Attribution — You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

NonCommercial — You may not use the material for commercial purposes.

No additional restrictions — You may not apply legal terms or technological measures that legally restrict others from doing anything the license permits.