Financial literacy education models for 7-12 years old based on the local wisdom of Sasak tribe

DOI:

https://doi.org/10.47750/pegegog.12.02.05Keywords:

Financial literacy, Family, Sasak’s local wisdom, Sasak tribe, Children aged 7-12 years oldAbstract

Penelitian ini bertujuan untuk mendeskripsikan dan merumuskan model pendidikan literasi keuangan berbasis kearifan lokal pada usia 7-12 tahun pada suku Sasak. Studi kasus ini menggunakan metode penelitian kualitatif eksploratif-deskriptif. Partisipan dalam penelitian ini dipilih melalui metode random sampling dan snowball, yang terdiri dari 630 keluarga dengan anak berusia 7-12 tahun, dan 177 anak yang ayah dan ibunya adalah keturunan bangsawan Sasak adalah Desa Suradadi Lombok Timur Nusa Tenggara Barat. . Data dikumpulkan melalui teknik wawancara, observasi, dan dokumentasi serta dianalisis melalui analisis isi dan komparatif. Hasil penelitian menunjukkan lima model pendidikan literasi keuangan berbasis kearifan lokal Sasak diberikan sejak anak berusia 7-12 tahun.Pertama , menanamkan perilaku “ itiq ” kepada anak, kedua memasukkan “ gen ” (tekun dalam mengelola keuangan dan membuat rencana keuangan), ketiga , menerapkan “ penunah ” (menghargai sumber daya yang dimiliki) kepada anak, keempat , Checklists Memverifikasi “ semaik-Maik ” (berhemat / TIDAK using Sumber Daya Beroperasi Berlebihan, khususnya Uang) ditunjukan kepada Anak-Anak, Dan Kelima , menggabungkan “ salingpeliwat ” (gotong royong) ditunjukan kepada Anak-Anak.Berbagai model pendidikan literasi keuangan diterapkan oleh para orang tua suku Sasak dengan tidak satu strategi tetapi campuran, seperti role modeling, pembiasaan, makan malam bersama, diskusi hanya nasihat langsung dan tidak langsung melalui peribahasa Sasak.

Downloads

References

Arofah, A. A., Purwaningsih, Y., & Indriayu, M. (2018). International Journal of Multicultural and Multireligious Understanding Financial Literacy , Materialism and Financial Behavior. International Journal of Multicultural and Multireligious Understanding, 5(4), 370–378.

Bucciol, A., & Veronesi, M. (2014). Teaching children to save: What is the best strategy for lifetime savings? Journal of Economic Psychology, 45, 1–17. https://doi.org/10.1016/j.joep.2014.07.003

Flick, U. (2019). Qualitative Data Analysis. In Research Methods for Public Administrators. https://doi.org/10.4324/9781315701134-11

Grohmann, A. (2018). Paci fi c-Basin Finance Journal Financial literacy and fi nancial behavior : Evidence from the emerging Asian middle class. Pacific-Basin Finance Journal, 48(July 2017), 129–143. https://doi.org/10.1016/j.pacfin.2018.01.007

Grohmann, A., Kouwenberg, R., & Menkhoff, L. (2015). Childhood roots of financial literacy. Journal of Economic Psychology, 51(September), 114–133. https://doi.org/10.1016/j.joep.2015.09.002

Huston, S. J. (2012). Financial literacy and the cost of borrowing. International Journal of Consumer Studies, 36(5), 566–572. https://doi.org/10.1111/j.1470-6431.2012.01122.x

Jayaraman, J. D., Jambunathan, S., & Adesanya, R. (2019). Financial literacy and classroom practices among early childhood and elementary teachers in India and the US. Education 3-13, 47(6), 746–759. https://doi.org/10.1080/03004279.2018.1533030

Kim, J., LaTaillade, J., & Kim, H. (2011). Family Processes and Adolescents’ Financial Behaviors. Journal of Family and Economic Issues, 32(4), 668–679. https://doi.org/10.1007/s10834-011-9270-3

Lermitte, paul W. (2004). Agar Anak Pandai Mengelola uang. Gramedia Pustaka Utama.

Lewis, G. J., & Bates, T. C. (2018). Higher levels of childhood intelligence predict increased support for economic conservatism in adulthood. Intelligence, 70(February), 36–41. https://doi.org/10.1016/j.intell.2018.07.006

Mayasari, M. (2019). Kontribusi Perspektif Ekonomi Feminis dalam Pendidikan Ekonomi Keluarga Suku Melayu Jambi untuk Menanamkan Perilaku Ekonomi Pancasila. Jurnal Ilmiah Dikdaya, 9(1), 62. https://doi.org/10.33087/dikdaya.v9i1.141

Mills, A., Durepos, G., & Wiebe, E. (2012). Encyclopedia of Case Study Research. In Encyclopedia of Case Study Research. https://doi.org/10.4135/9781412957397

Mintarti, S. I. (2017). Analisis Pendidikan Keuangan Dalam Keluarga ,. Pluralisme Dalam Ekonomi Dan Pendidikan.

Moleong, L. J. (2018). Metodologi Penelitian Kualitatif. PT Remaja Rosdakarya.

Moreno-Herrero, D., Salas-Velasco, M., & Sánchez-Campillo, J. (2018). Factors that influence the level of financial literacy among young people: The role of parental engagement and students’ experiences with money matters. Children and Youth Services Review, 95(October), 334–351. https://doi.org/10.1016/j.childyouth.2018.10.042

Morton, J. (2005). The Interdependence of Economic and Personal Finance Education. Social Education, 69(2), 66.

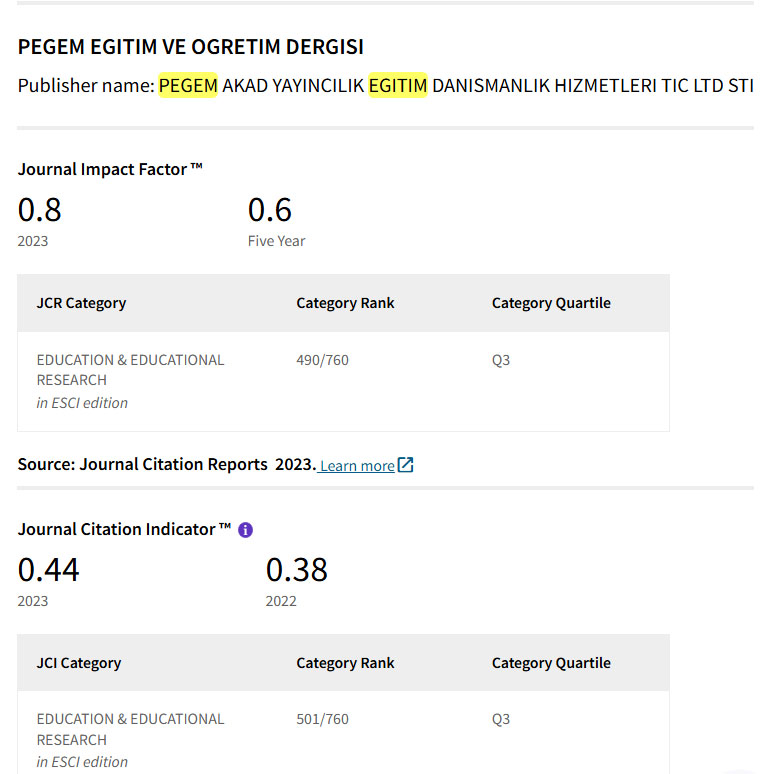

Ozdemir, B., & Uyanik, G. K. (2021). Evaluation of a Developed Financial Literacy Program in High School Students. Pegem Egitim ve Ogretim Dergisi, 11(3), 26–33. https://doi.org/10.14527/pegegog.2021.00

Potrich, A. C. G., Vieira, K. M., & Mendes-Da-Silva, W. (2016). Development of a financial literacy model for university students. Management Research Review, 39(3), 356–376. https://doi.org/10.1108/MRR-06-2014-0143

Richard M. Eisler, L. W. F. (1980). Perfecting Social Skills: A Guide to Interpersonal Behavior Development. Plenum Press. https://books.google.gr/books?hl=en&lr=&id=zEpWBgAAQBAJ&oi=fnd&pg=PA3&dq=dating skills&ots=rihncX7PiH&sig=e0221On2GyT3byQTNZfOjp2LiKc&redir_esc=y&fbclid=IwAR3zQTAIlKoQ2CmUMNRcPECpqEeIvzR4QhOlAMy45pT3qeuRTu9dlfUJVII#v=onepage&q=dating skills&f=false

S. Umi, M. (2018). Model Pendidikan Ekonomi Anak Usia Dini Untuk Membendung Sikap Konsumerisme Pada Usia Dewasa. Perpustakaan UM. lib.um.ac.id

Sina, P. G. (2008). Peran Orangtua dalam Mendidik Keuangan pada Anak ( Kajian Pustaka ). Jurnal Pengembangan Humaniora, 14(1), 74–86.

Subroto, R. (2016). Pendidikan Literasi Keuangan Pada Anak: Mengapa dan Bagaimana? Scholaria, 6(Mei), 14–28.

Sumarwati, Sukarno, & Anindyarini, A. (2020). The effect of educative comics on traditional ecological knowledge literacy about corn food security in elementary school. International Journal of Intruction, 14(3), 981–998. https://doi.org/10.1145/3452144.3453773

Sutter, M., Zoller, C., & Glätzle-rützler, D. (2019). Economic behavior of children and adolescents – A first survey of experimental economics results. European Economic Review, 111, 98–121. https://doi.org/10.1016/j.euroecorev.2018.09.004

Te’eni-Harari, T. (2016). Financial literacy among children: the role of involvement in saving money. Young Consumers, 17(2), 197–208. https://doi.org/10.1108/YC-01-2016-00579

Temizel, F., & Ozguler, İ. (2015). FİNANSAEği̇ti̇me Bakiş. Business & Management Studies: An International Journal, 3(1), 1–16. https://doi.org/10.15295/bmij.v3i1.85

Umi, S., Widjaja, M., Malang, U. N., Haryono, A., Malang, U. N., Wahyono, H., Malang, U. N., & Province, W. N. T. (2021). Pancasila Economic Character Literacy Program for High School Students. International Journal of Instruction, 14(1).

Webley, P., & Nyhus, E. K. (2006). Parents’ influence on children’s future orientation and saving. Journal of Economic Psychology, 27(1), 140–164. https://doi.org/10.1016/j.joep.2005.06.016

Yuwono, W., & Batam, U. I. (2020). Konseptualisasi Peran Strategis dalam Pendidikan Literasi Keuangan Anak melalui Pendekatan Systematic Review. November. https://doi.org/10.31004/obsesi.v5i2.663

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Pegem Journal of Education and Instruction

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Attribution — You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

NonCommercial — You may not use the material for commercial purposes.

No additional restrictions — You may not apply legal terms or technological measures that legally restrict others from doing anything the license permits.